Dave Ramsey’s 8% Withdrawal Rate

Having spent the better part of the last 10 years in Japan, I have not been all that familiar with Dave Ramsey. Sure, I’ve heard from time to time that there is a radio show financial guru who talks about 12% market returns and an 8% withdrawal rate in retirement, but that sounded so farfetched that I guess I thought it was an urban legend. Apparently, it is true.

Dave Ramsey got into a bit of a kerfuffle this past weekend on Twitter in his response to fiduciary planners about the nature of his investment advice. He was questioned about the prudence of suggesting 12% returns and recommending loaded mutual funds to his listeners. Because what he promotes is seemingly unjustifiable, he lashed out at these financial planners for challenging him, indicating that he can help more people in 10 minutes than they help in their entire lives, and that they are all snobs because they do not help regular people.

In March, I debunked the myth of the 8% return. Dave Ramsey takes that a step further by promoting 12% returns, but he is simply making all of the mistakes described in that post to an even larger degree.

There is a lot of distrust toward the financial services industry, and while much of it is justified, sometimes consumers should share a bit of responsibility. I could recently see how this plays out, and how honest financial planners can be pushed out of the business. As I’m not a financial planner myself, I don’t have to worry about obtaining clients. I was recently talking to someone about getting started in investing, explaining the benefits of a low-cost index fund approach. The conversation was going fine, and then he asked me what return he should expect from such a portfolio. The question caught me off guard, because once you have a sound strategy you need to be ready to receive whatever the market provides, but then I started getting into some of the issues from the myth of 8% return column. If I had been a financial planner seeking clients, I can see that this is where I would’ve likely lost this lead. He could have then said, well thank you Mr. Pfau for your time, but I’ve been listening to Dave Ramsey and he knows how to pick mutual funds that offer a 12% return. I think I will take my business to one of his affiliated advisers so that I can get access to those high earning funds.

This is the fundamental trouble facing honest people trying to make a living in the financial services industry. There is always going to be someone willing to suggest that higher returns are possible. Consumers will naturally gravitate toward whoever is offering them the best story about how they can achieve riches. With his 12% returns, Dave Ramsey sits at the top of the financial services heap. And as his business model of using affiliated advisers who pay him a fee and sell you commissioned high-load mutual funds depends on maintaining the fiction of 12% returns, there is no way he can step down when challenged about this issue. So he sidesteps the issue and makes personal attacks instead.

When it comes to retirement, Dave Ramsey says you should be 100% stocks and that this will support an 8% inflation-adjusted withdrawal rate. It sounds wonderful. Certainly that allows for a lot more spending than what you would think possible if you’re a regular reader of this blog. But this number comes from a completely ludicrous basis. He opened an Excel spreadsheet, assumed a fixed annual return of 12% [Bernie Madoff might even be jealous of that return sequence], and determined that 8% is a sustainable withdrawal rate with inflation of 4% and that wealth will never be depleted. The problem with this is so basic that it’s hard to believe Dave Ramsey is ignorant about it. It’s the sequence of returns risk. It’s what William Bengen illustrated in the 1990s. The sustainable withdrawal rate can be less than the average portfolio return because people are taking income out of the portfolio, and when the market is down the funds they take out don’t get the chance to rebound on the subsequent recovery.

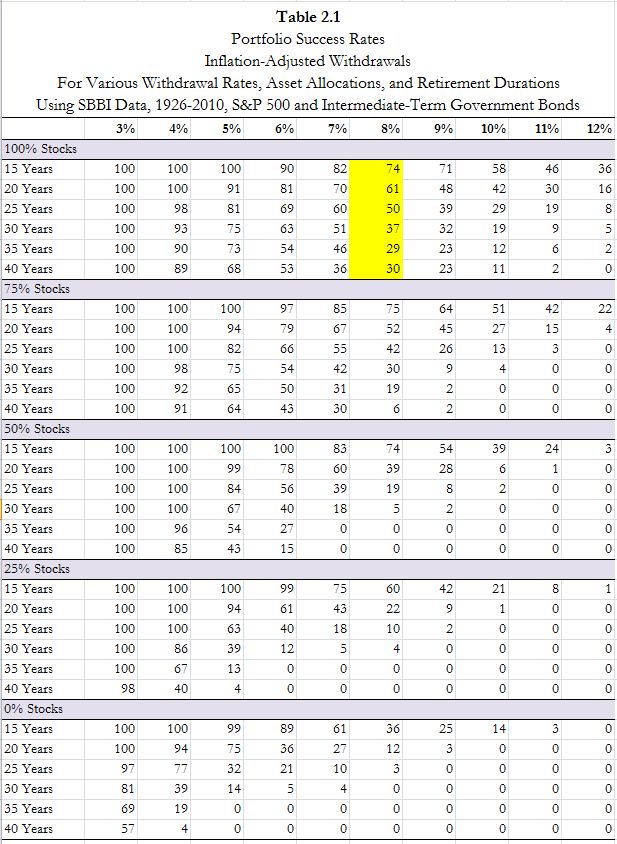

Readers of this blog know that I am not a big fan of the Trinity study. But once in a while, the study can be dusted off and put to some use when helping to dispel some bizarre notions. The Trinity study simply tells us the percentage of historical periods in the US when a particular retirement income strategy would have worked. In the following table, what we want to focus on is the Dave Ramsey strategy of using an 8% withdrawal rate and a portfolio of 100% stocks. In 74% of the historical cases, this would’ve supported 15 years the spending (or in other words, in 26% of cases someone following Dave Ramsey’s strategy would have ran out of wealth within 15 years). Over 25 years, someone has the coin flip to whether this strategy will work, as it has a 50% success rate. Over the more typical retirement planning horizon of 30 years, Dave Ramsey strategy would have worked in only 37% of the historical cases. As retirement lengthens the success rate continues to fall.

And these numbers are pre-fee. If you pay a 5.75% load at the beginning, your effective withdrawal rate would be pushed up to 8.5% for the purposes of this table. And this is still optimistic, because it assumes that the recommended mutual fund manager is able to outperform the market enough to cover the active management fees they charge, which is an exceedingly unlikely outcome over a long period of time.

Someone may still decide to use Dave Ramsey’s strategy if they have low aversion to outliving their financial assets, but “regular people” must understand what they are potentially getting themselves into with that advice.

(Just a technical note: for longer time periods there are fewer historical simulations and so sometimes you see an increase in success rates because one of the failures gets cut off… That happens with the 35 years and 40 year retirement periods)

McLean Asset Management Corporation (MAMC) is a SEC registered investment adviser. The content of this publication reflects the views of McLean Asset Management Corporation (MAMC) and sources deemed by MAMC to be reliable. There are many different interpretations of investment statistics and many different ideas about how to best use them. Past performance is not indicative of future performance. The information provided is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy or sell securities. There are no warranties, expressed or implied, as to accuracy, completeness, or results obtained from any information on this presentation. Indexes are not available for direct investment. All investments involve risk.

The information throughout this presentation, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission there of to the user. MAMC only transacts business in states where it is properly registered, or excluded or exempted from registration requirements. It does not provide tax, legal, or accounting advice. The information contained in this presentation does not take into account your particular investment objectives, financial situation, or needs, and you should, in considering this material, discuss your individual circumstances with professionals in those areas before making any decisions.